Table of Content

The interest burden will increase by Rs 2.95 lakh for the entire tenure. HDFC also offers a facility of a pre-approved home loan even before you have identified your dream home. A pre-approved home loan is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position. If you purchase an under construction property you are generally required to service only the interest on the loan amount drawn till the final disbursement of the loan and pay EMIs thereafter. In case you wish to start principal repayment immediately you may opt to tranche the loan and start paying EMIs on the cumulative amounts disbursed. Our tailor made home loans caters to customers of all age groups and employment category.

Leading private sector lender HDFC has hiked the retail prime lending rate by 0.50% with effect from October 1, 2022. The increased interest rate will reflect in the monthly EMI of customers from the next reset date. Regular prepayment will significantly lower the outstanding loan amount. The most popular duration for loan repayment that borrowers opt for is 20 years. However, if one wants to lower EMIs, she can extend the tenure of loans. The downside of availing this is that she would have to pay a bigger interest amount.

Can I increase and decrease my HDFC Home Loan EMI ?

This option provides you the flexibility to increase the EMIs every year in proportion to the increase in your income which will result in you repaying the loan much faster. Similar to this, ICICI Bank's festive offer rate starts at 8.75 per cent for those with a minimum credit score of 750. If you have taken a home loan of Rs 30 lakh for 15 years, on which you have to pay EMI of Rs at the rate of 8.75%. But after increasing the interest rates of HDFC, the new rates will be 9.10 per cent and the EMI will have to be paid at Rs 30,607. HDFC joins a number of lenders that have recently raised interest rates, including state-run Punjab National Bank, ICICI Bank and Bank of Baroda.

The minimum home loan rate of State Bank of India is 8.75% per annum. Loan against property gives you access to immediate funds by placing your property as collateral... It makes sense to take a home loan to meet the purchase value of the home. SpiceJet has proposed to settle the dues of aircraft leasing companies by turning them into potential investors from creditors, according to people aware of the discussions. With effect from December 20, 2022, Home Development Finance Corporation Ltd. increased its Retail Prime Lending Rate by 35 basis points.

What is a Pre-Approved Home Loan?

However, the high interest rates can add up to almost double the amount of your loan, even if your EMIs seem low. A smart financial strategy would involve a plan to recover the interest paid on the home loan EMI so that you have more savings at the end of the day. If paying more EMI is not a problem, one can be prudent and increase her monthly repayment installment. This would help her repay the loan faster, which means she would have to pay lesser interest. The EMI calculator helps you arrive at the right home loan amount that best fits your monthly budget, by helping you decide the loan EMI and tenure most suitable to your financial position.

Apart from this, he can also apply for his favorite credit card. The main portion of your home loan is repaid with any additional payments you make above your normal EMI. You can lower your EMI if you don’t have extra income and are worried about running out of money.

Home loans EMI: How to control rising EMI, know details here

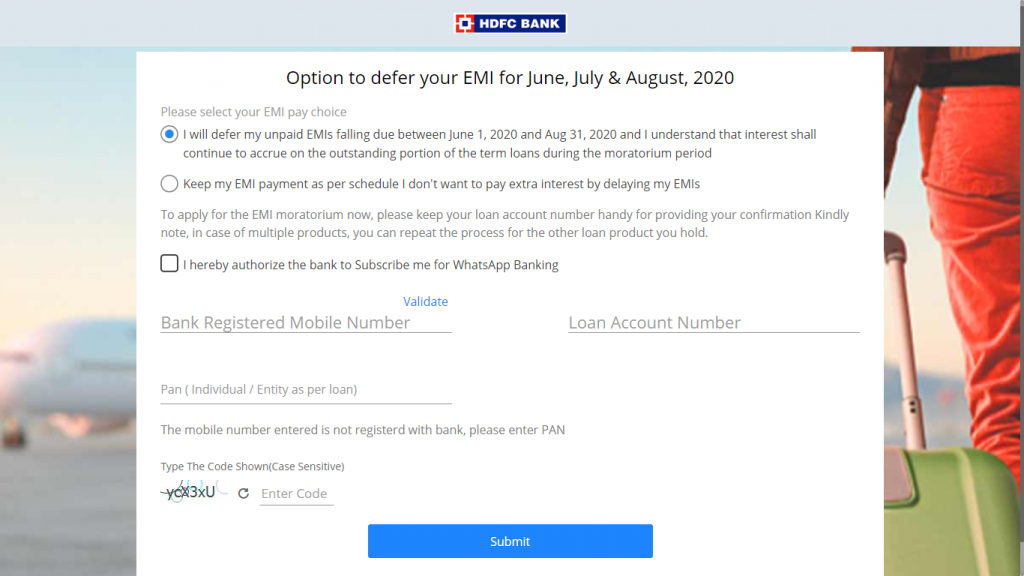

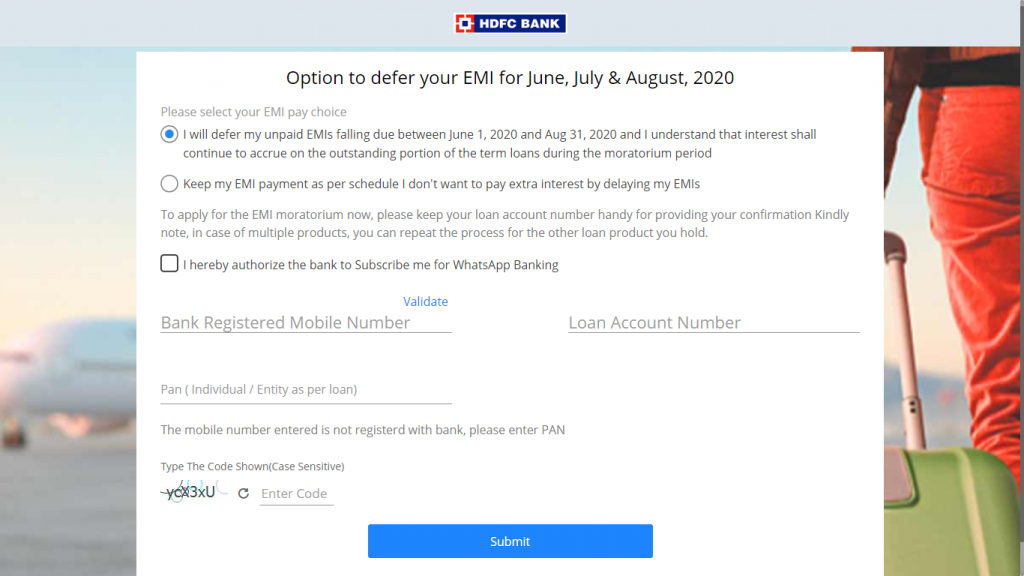

After getting an estimate of EMI using the calculator, you can apply for a home loan online from the comfort of your living room easily with Online Home Loans by HDFC. The hike, which will come into effect from May 9, will be applicable to existing as well as new borrowers. A customer will have to pay 8.15% interest in the case of an RLLR loan and 8.55% in the case of an EBLR loan. However, the actual impact on EMI would also depend on various factors like CIBIL score, borrower’s profile, loan to value ratio, risk assessment, payment failure, etc.

To mitigate the impact of rising interest rates, the existing home loan borrowers can either their equated monthly instalments or their loan tenures. “Note that opting for the tenure increase option would result in higher interest cost than the EMI increase option," Kukreja added. The monthly EMIs that will be debited from your bank account also increases as the interest rate on your home loan increases. Note that the interest rates are subject to the credit/ risk profile as assessed by HDFC based on certain parameters such as credit scores, segments, repayment of other loans, etc.

According to HDFC, only customers with credit scores of 800 or higher will be eligible for the new rate of 8.65 per cent.

HDFC said in its statement, “HDFC has decided to increase its Retail Prime Lending Rate on housing loans. Adjustable Rate Home Loan has been increased by 35 basis points. Borrowers having limited liquidity can opt for the home saver option. Under this facility, an overdraft account is opened in the form of a current or savings account where the borrower can park his surpluses and withdraw from it as per his financial requirements. The interest component of the home loan is calculated after deducting the surpluses parked in the savings/current account from the outstanding home loan amount.

Let’s say you have taken a loan of Rs. 25 lakh for a tenure of 20 years at 8.6% interest. Being a homeowner is one of the most fulfilling experiences for most people. Since this requires a large capital outlay, it makes sense to take a home loan to meet the purchase value of the home. This not only does away with having to wait for years to accumulate the necessary amount to purchase your home, a home loan also provides attractive tax benefits. Go through the list of documents required and keep them ready before starting your home loan application process.

According to HDFC, only customers with credit scores of 800 or higher will be eligible for the new rate of 8.65 per cent. Since there is no penalty on pre-payment of home loan, therefore bank should not object to increasing your EMI. The additional amount that you pay over and above your actual EMI shall be considered as Principal repayment and that much amount can directly be adjusted from the outstanding principal. You can go to HDFC Limited or HDFC Local bank with the most recent loan statement. It must show the amount of interest and principal that has been paid so far and the remaining balance that needs to be paid.

First read breaking news in Hindi News18 Hindi

No comments:

Post a Comment